Bullion prices play a critical role in the global economy, influencing investors, central banks, and commodity traders. Whether you are considering gold, silver, platinum, rhodium or palladium, understanding bullion price trends and the factors affecting them is essential for making informed investment decisions. In this article, we will explore what drives bullion prices, how they are determined, and the best strategies for investing in precious metals.

What is Bullion?

Bullion refers to precious metals like gold, silver, platinum, and palladium in their purest form. These metals are typically traded in bars, ingots, or coins and are valued based on their weight and purity rather than aesthetic appeal or collectibility.

Factors Affecting Bullion Prices

Several factors influence bullion prices, including:

- Supply and Demand

- Gold and silver mining production affects availability.

- Industrial demand for silver, platinum, and palladium impacts prices.

- Central banks’ buying and selling influence gold prices significantly.

- Economic Conditions

- Inflation and deflation impact bullion prices; during inflation, gold and silver are seen as safe-haven assets.

- Economic uncertainty often drives investors toward precious metals.

- Geopolitical Events

- Political instability and global crises increase demand for bullion as a hedge against risk.

- Trade wars and sanctions can disrupt supply chains, affecting prices.

- Currency Strength and Exchange Rates

- A weaker U.S. dollar typically leads to higher bullion prices.

- Exchange rates impact international bullion trading.

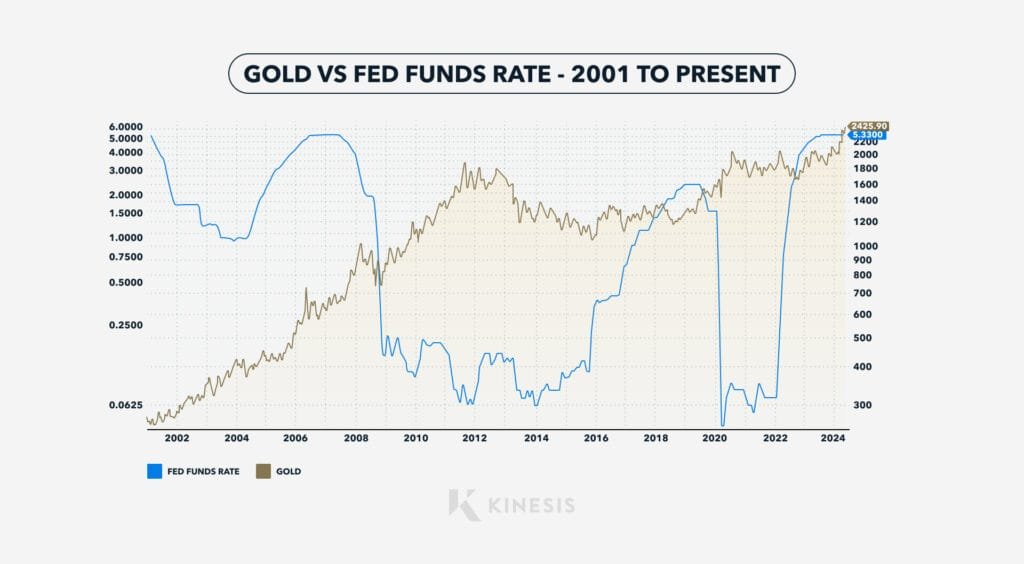

- Interest Rates and Monetary Policies

- When interest rates are low, bullion becomes more attractive as it does not yield interest but retains value.

- Central banks’ monetary policies and gold reserves influence gold prices.

- Market Speculation and Investment Trends

- ETFs, hedge funds, and retail investors contribute to price fluctuations.

- Futures contracts impact short-term price volatility.

Bullion Price Trends

Historically, bullion prices have exhibited cyclical movements. For example:

- Gold: Prices surged during the 2008 financial crisis and the COVID-19 pandemic, reinforcing its role as a safe-haven asset.

- Silver: Known for volatility, silver sees price swings influenced by industrial demand and speculative trading.

- Platinum and Palladium: Industrial demand for automotive catalytic converters significantly affects these metals.

How Bullion Prices Are Determined

Bullion prices are primarily determined by:

- Spot Price: The current market price for immediate delivery of the metal.

- Futures Price: The agreed price for future delivery, influenced by speculation.

- Premiums and Discounts: Physical bullion prices include additional costs like fabrication and dealer margins.

Recent Trends in Bullion Prices

In 2024, bullion markets experienced significant movements:

- Gold: Prices surged nearly 27%, marking the strongest performance since 2010. This increase was driven by geopolitical tensions and substantial central bank purchases. newsminimalist.com

- Silver: While specific figures vary, silver mirrored gold’s upward trajectory, influenced by industrial demand and investment inflows.

- Platinum and Palladium: These metals saw price fluctuations due to shifts in automotive industry demand and supply constraints.

Investment Strategies for Bullion

Investors can consider several strategies when investing in bullion:

- Physical Bullion Investment

- Buying gold and silver bars or coins ensures direct ownership.

- Requires secure storage and insurance.

- Exchange-Traded Funds (ETFs)

- ETFs provide exposure to bullion prices without physical storage hassles.

- Suitable for those looking for liquidity and ease of trading.

- Mining Stocks and Mutual Funds

- Investing in mining companies allows indirect exposure to bullion prices.

- Mining stocks can be more volatile than physical bullion.

- Futures and Options Trading

- Suitable for experienced investors looking for leveraged exposure.

- High-risk due to price volatility and leverage effects.

Conclusion

Bullion prices are influenced by a complex interplay of geopolitical events, central bank activities, monetary policies, currency movements, and economic indicators. The significant rise in gold prices in 2024 underscores the metal’s enduring appeal as a safe-haven asset amid global uncertainties. Investors should remain informed about these factors and consider their risk tolerance and investment objectives when engaging with the bullion market.

Note: The information provided in this article is based on data available up to March 2025. Market conditions can change rapidly, and past performance is not indicative of future results.

If you’re looking to invest in bullion grade precious metals(Gold, Silver,Platinum,Rhodium) at faire prices, do check out our our shop Here